Houston Real Estate Market Report March 2020

Covid-19 shows little measureable effect on Houston’s March home sales according to the latest monthly Market Update from the Houston Association of Realtors (HAR). Even with some transactions interrupted before Governor Greg Abbott designated real estate as an “essential” service statewide as part of his March 31 stay-at-home order, Houston home sales were more than 11 percent ahead of the levels at this point in 2019. Its impact on the Houston real estate market only began to set in during the last week of March, and therefore caused little disruption to the month’s overall performance. The full effect of the pandemic is expected to become more apparent when the April housing numbers are tallied.

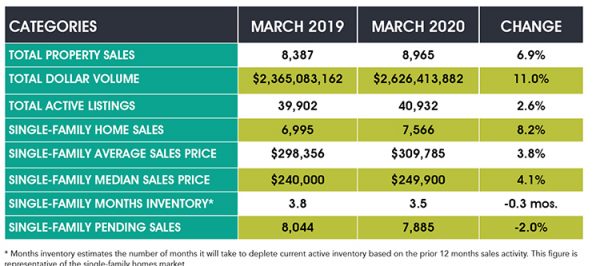

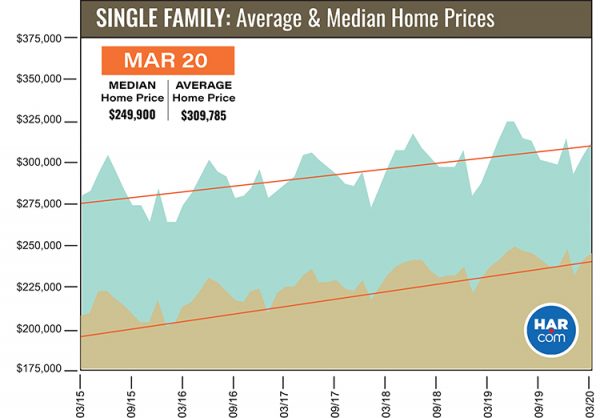

According to the update, 7,566 single-family homes sold in March compared to 6,995 a year earlier, accounting for an 8.2 percent increase and the ninth consecutive month of positive sales. Single-family homes priced between $500,000 and $750,000 led the way in March sales, followed by homes in the $250,000 to $500,000 range. Leases of single-family homes were also up for the month. The single-family home median price (the figure at which half of the homes sold for more and half sold for less) rose 4.1 percent to $249,900, and the average price climbed 3.8 percent to $309,785. Both figures represent the highest prices ever for a March.

- Single-family home sales rose 8.2 percent year-over-year, with 7,566 units sold, marking the ninth consecutive month of positive sales;

- The Days on Market (DOM) figure for single-family homes was unchanged at 65 days;

- Total property sales rose 6.9 percent, with 8,965 units sold;

- Total dollar volume jumped 11.0 percent to more than $2.6 billion;

- The single-family home median price rose 4.1 percent to $249,900, reaching a March high;

- The single-family home average price climbed 3.8 percent to a March high of $309,785;

- Single-family homes months of inventory was at a 3.5-months supply, down from 3.8 months last March but above the national inventory level of 3.1 months;

- Townhome/condominium sales declined 0.5 percent, with the average price up 6.0 percent to $224,038 and the median price up 4.6 percent to $183,000;

- Lease properties experienced a mixed performance, as single-family home rentals increased 1.2 percent with the average rent up 2.4 percent to $1,788;

- Volume of townhome/condominium leases fell 9.7 percent with the average rent up 4.2 percent to $1,604.